Regulatory capture and unintended consequences

In recent times, public regulatory bodies throughout the Western world have grown increasingly agitated by the emergence of a parallel financial system slipping from their grasp. Often, regulatory efforts revolve around enforcing serious-sounding acronyms like 'FATF Guidelines' or 'KYC/AML requirements'.

I'll die on the hill that governments should be expected to demonstrate that FATF Guidelines or KYC/AML requirements are both

Compliant with basic civil liberties enshrined in most Western countries

Effective

As it stands, neither claim can be supported with persuasive evidence. Without both of these conditions, these so-called 'requirements' should not be considered acceptable.

Counterarguments often reference North Korea and illicit financial flows, but I find it hard to believe that the handwringing about 'money laundering' or 'crimes' is genuine. This skepticism stems not only from the obvious characteristics of decentralized currencies that make them highly unsuitable for 'money laundering' or 'crimes', but also because it doesn't take much reading to realize that the core issue at stake is one of control:

A democracy can only endure if any claims to control can be countered with a safety valve, such as reelection triggers, no-confidence motions, opt-outs, public referenda, or other mechanisms that can curb the government's power. Without these, unopposed claims to control undermine democracy, pushing the technocratic state further into the private sphere. Increasing technocratic control becomes a self-perpetuating cycle, as it only serves to boost tax collection, which in turn sustains the cycle.

These claims to control also establish extractive oligopolies, often disguised as 'public safety' or 'compliance'. The true beneficiaries of regulatory capture are incumbents, who lack any civic motive to defend and are all too happy to comply. These market distortions can emerge out of seemingly benign intentions, as in the case of tobacco excise tax regulations.

Most countries impose an excise tax on tobacco consumption, supposedly to account for the externalities of tobacco smoking and raise the barrier to entry to the habit, all in the name of protecting public health. However, it also represents a significant portion of government revenues (anywhere between 2-7% for OECD countries).

In an ideal governance scenario, an opt-out mechanism would incentivize civil servants to employ these revenues diligently. However, in the absence of such opt-outs, these mechanisms harbor the potential for extractive forces to germinate around good intentions and metastasize into disastrous outcomes.

Tobacco consumption tends to display relative inelasticity to tax, meaning that a 10% increase in excise does not result in a 10% decrease in consumption. Consequently, raising excise almost always leads to higher government revenues.

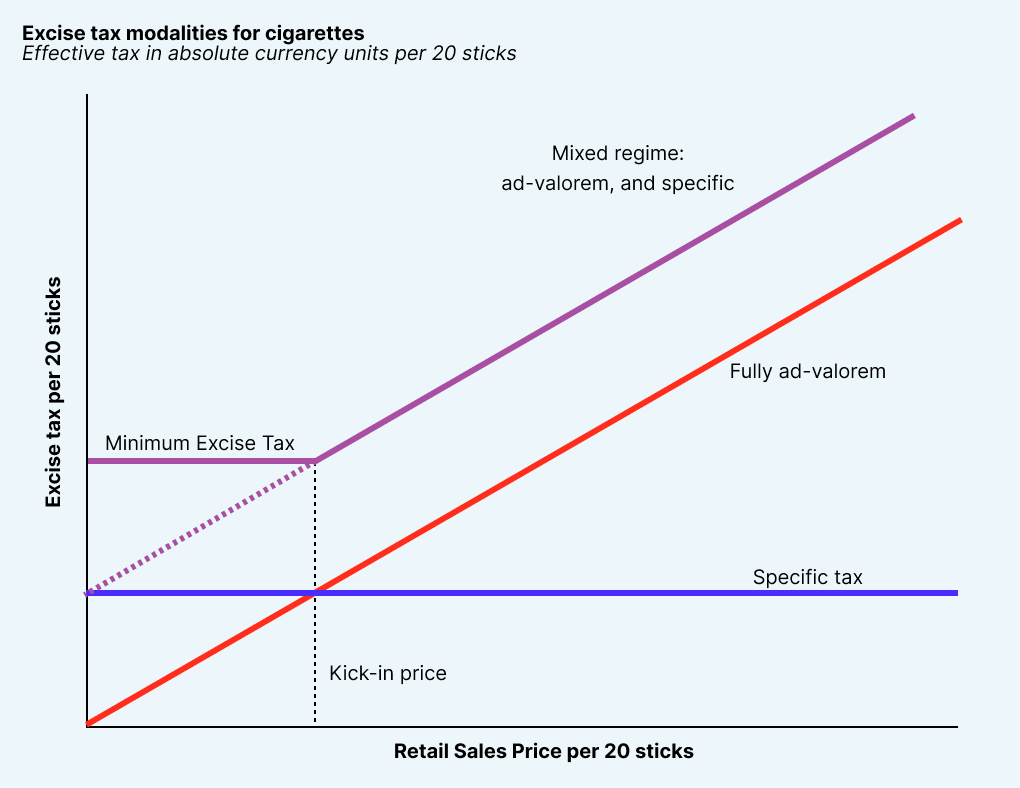

There are numerous ways to impose excise tax on tobacco products. After years of exerting pressure on tobacco consumers, excise tax revenues have become highly optimized. As expected, the EU pioneers in complexity and refinement in this arena. Generally, there are three types of excise tax that can be applied to a pack of 20 cigarettes:

Specific tax: Charge a fixed amount for all packs, regardless of their value

Fully ad-valorem: Charge a consistent proportion of the pack's value

Mixed regime: Ad-valorem above a minimum threshold, creating an effective 'kick-in price' at which ad-valorem components kick in and a floor price for all packs

Major tobacco companies with high margins argue that a mixed regime excise tax is better for consumer health than ad-valorem, as the higher minimum price raises the barrier to entry for consumption.

However, this argument is dubious at best. The optimal outcome for public health would be for people to abstain from smoking altogether. Any form of excise tax increases the entry cost for new tobacco companies, protecting the margins of incumbent players. By setting a higher floor price for cigarettes, the market is driven to form at the lower end, closer to the price points at which large tobacco companies operate. This effectively forces low-end tobacco brands to compete in premium segments, where they're likely to lose.

In the end, we're faced with a situation where:

Government tax revenues increase

Large oligopoly profit margins and market dominance increase

Consumer health remains unchanged

To bring the discussion back to DeFi, Balancer LP pools have the potential to replace BlackRock's iShares business entirely. After all, there's no reason for an intermediary to charge fees and collect passport PDFs on a 60/40 ETF. But for its full disruptive power to benefit consumers, the infrastructure for the pools must remain neutral.

In this scenario, BlackRock would disintegrate as a controlling industry extractor, giving way to direct interactions between tokenizers and consumers. If necessary, some of these interactions can even go through KYC so that the passport PDF storage industry survives. But the infrastructure itself must remain agnostic to truly improve consumer welfare. Governments must be willing to forego imposing KYC checks on Balancer because it's absurd, ineffective at solving crime, and virtually impossible to implement.

KYC and AML 'requirements' are the excise tax of financial service industries. Consumers are inelastic to increased costs that wind their way up in higher fees, as people need financial services. Moreover, KYC/AML 'compliance' sets a floor for operating expenses that makes it difficult for new players to enter and disrupt incumbent market participants. Finally, KYC/AML provides a new source of control and information to government authorities, which ultimately proves extractive through the potential to enact and collect higher tax revenues.

This leads to a situation where:

Government controls over civil liberties increase (and therefore tax collection increases)

Large oligopoly profit margins and market dominance increase

Consumer financial protection remains unchanged (or worsened)

However, there is a crucial difference between Balancer LP pools and Camel cigarettes: the degree of control a government can effectively enforce. If you want to use DeFi, you can just go ahead and use it. This characteristic embodies its disruptive potential and poses a threat to government authority alluded to in the earlier quotes from government officials chirping about losing control.

In an alternate timeline, governments rally around a nascent industry to oust scammers and safeguard innovations, giving them a chance to test the market and thrive. In that reality, the EU Parliament runs Ethereum validators in Strasbourg and Brussels, allocating staking rewards to startup grants or educational programs.

I'd love to see that timeline come to fruition. However, the potential for change will persist regardless. Governments must choose which side of history they want to land on, and whether they want to cling to ineffective rule-making or contribute to improving consumer welfare and financial autonomy. The choice is theirs, but the disruptive power of decentralized finance will continue to grow, with or without their support.